Use of Holding & Subsidiary Companies for the Ownership of Real Estate

Kendall County Real Estate Lawyers: Asset Protection & Real Estate Transactions Law

What is an LLC?

An LLC is a limited liability company owned by one or more "members." There are numerous benefits to forming an LLC. If a company is included as an LLC, liability for the managers and members is limited. The managers and owners are not personally liable for any possible debts or liabilities from the company. The members are not personally or individually responsible if debts or lawsuits occur. LLCs are vital if you want to protect your assets, as they will not be at risk if the company faces liability. Also, forming an LLC will prevent your company from being taxed twice through double taxation. Other corporations are likely to be subject to double taxation because the company pays taxes on the income and the owners of the company tax on the dividend income. LLCs avoid this double taxation. If the LLC is profitable, the profits go directly to the members, and these profits are only taxed once.

What is a Series LLC?

A series limited liability company (SLLC) is a type of LLC that provides asset protection across all “series” within the LLC. Each of these series is protected from any liability that may arise from any of the other series. Each series and its assets, liabilities, interests, and business operations are segregated from the other series. With a Series, LLC comes numerous benefits. Asset protection, as mentioned, is the most significant advantage. If one series is exposed to liability, the other series are protected even though they are under the same "parent" LLC. Another advantage is that each series, manager, and member is liable only for their debts and liabilities. Also, each series may comprise different managers and members; they are optional throughout. Lastly, creating a Series LLC is more straightforward, often less costly, and challenging to manage than creating multiple LLCs.

How to Use Holding Companies?

Holding companies are slightly different than Series LLCs. Holding companies are sometimes called “parent” or “umbrella” companies. Holding companies do not produce or sell anything; instead, they segregate assets and minimize liabilities. Instead, they are used for oversight, supervision, and control of the subsidiaries, not day-to-day decisions. These holding companies may hire whoever they choose to be the subsidiaries' managers, who are essentially in charge and responsible for the subsidiaries. If one of the subsidiaries accrues a loss or liability, the holding company is protected against creditors. Unlike an SLLC, a holding company requires multiple LLCs to be formed, each holding different assets and each individually responsible for any liability that may arise. However, holding companies do not partake in any business activity; they "hold" onto each LLC's assets. These assets may include property, houses, stocks, trademarks, etc. Each time the business owner wants the holding company to hold onto the asset, a different LLC must be created.

Illinois Series LLC

The parent company's full name must be included in each series' name in Illinois. Each series is required to have a registered agent, which will be the same agent used for the parent LLC. This agent is required to be a resident of Illinois. After selecting an agent, the series LLC must file the Articles of Organizations, and then the Certificates of Designation are filed. After that, a series LLC Operating Agreement will be made. This outlines ownership, structure, and operations for the LLC. After this, an Employer Identification Number (EIN) must be obtained. This is a specific number used to identify a business in Illinois. This EIN is required to open a bank account for the company and is also used for tax purposes. Finally, Illinois requires the parent company to file an annual report with the Secretary of State on behalf of the series.

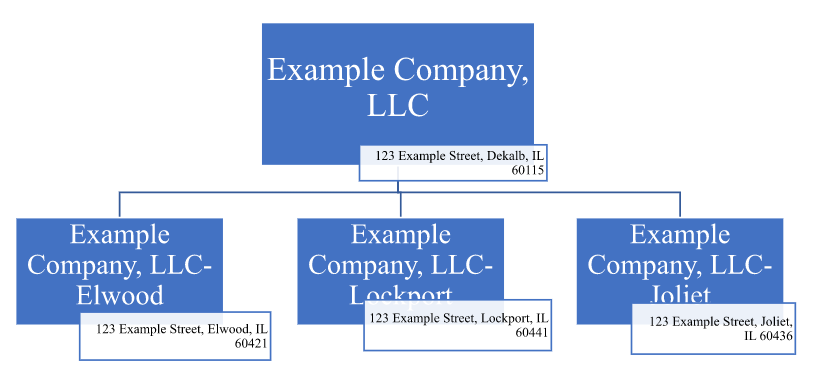

The chart below depicts Example Company, LLC. The “parent” company is Example Company, LLC. Example Company, LLC – Elwood, Example Company, LLC – Lockport, Example Company, LLC – Joliet are part of the Series LLC. Each of these series is individually responsible for its debts and liabilities.

Kendall County Business and Real Estate Attorneys: Asset Protection and Liability Strategies for Real Estate Investors

Gateville Law Firm is a boutique law firm serving the real estate investor community and providing advanced asset protection and liability reduction strategies for real estate investors. We handle Yorkville, Oswego, Plainfield, Plano, Sandwich, Somonauk, and surrounding areas. Call us today at 630-780-1034 to discuss your real estate and business legal needs.

Questions?

Contact Us Today

Call 630-780-1034 or fill out the form below to set up a free consultation today:

The use of the Internet or this form for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.

I have read and understand the Disclaimer and Privacy Policy.